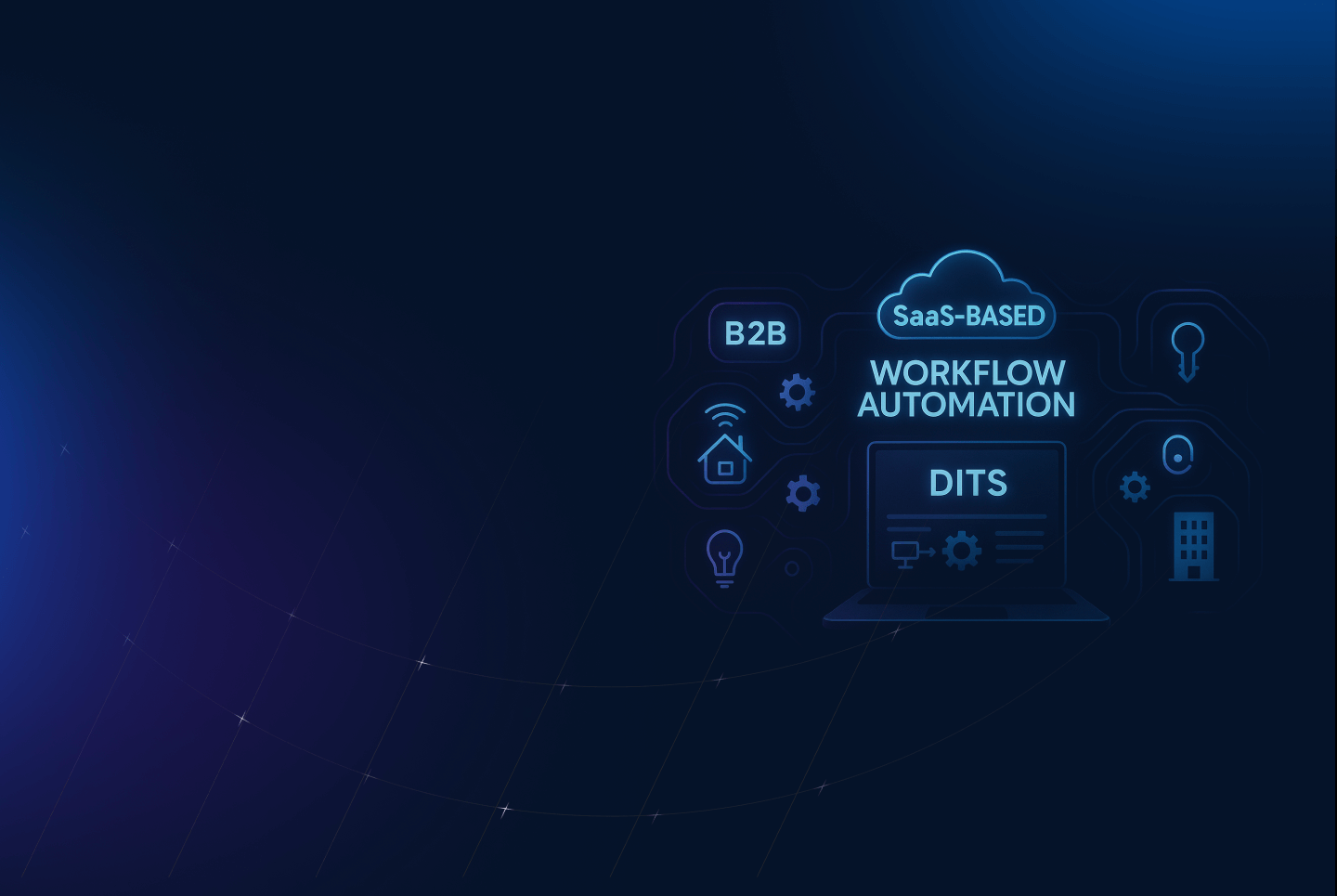

This SaaS-based auto claims management software platform streamlines insurance-driven vehicle repairs by connecting insurers, panel beaters, and suppliers on a unified digital ecosystem. Automating the entire claim lifecycle—from submission and validation to part procurement and settlement—it reduces delays, manual processes, and credit bottlenecks. Built by a seasoned automotive software development company, the platform features advanced supplier matching, document validation, and role-based workflows for conditional approvals. The result is a transparent, scalable, and efficient insurance workflow automation software solution tailored for large-scale automotive repair networks looking to digitize and optimize their operations.

Outdated manual systems created bottlenecks across claims lifecycle stages—causing approval delays, communication lags, and high error rates in repair networks.

Repairers faced operational hurdles due to restrictive credit approvals, which relied heavily on historical trade data rather than real-time decision-making.

Managing exceptions, duplicates, and approval chains manually created inefficiencies and compliance risks within the parts procurement and documentation process.

The absence of intelligent workflows meant slow supplier nominations and error-prone validation of part summaries—hindering timely repairs.

Stakeholders struggled with performance tracking and decision-making due to minimal access to real-time claims and supplier analytics.

The existing tech infrastructure couldn’t scale efficiently, impacting the ability to generate reports or add modern functionalities rapidly.

Purpose-built claims management software development that automates, validates, and streamlines multi-party interactions across the insurance repair lifecycle.

The platform's 3-tier backend separates APIs, business logic, and data repositories—delivering speed, modularity, and easier updates for future features and scaling.

Claims are routed conditionally: those under 90% are handled by administrators, while complex ones go to executives—ensuring accuracy and regulatory compliance.

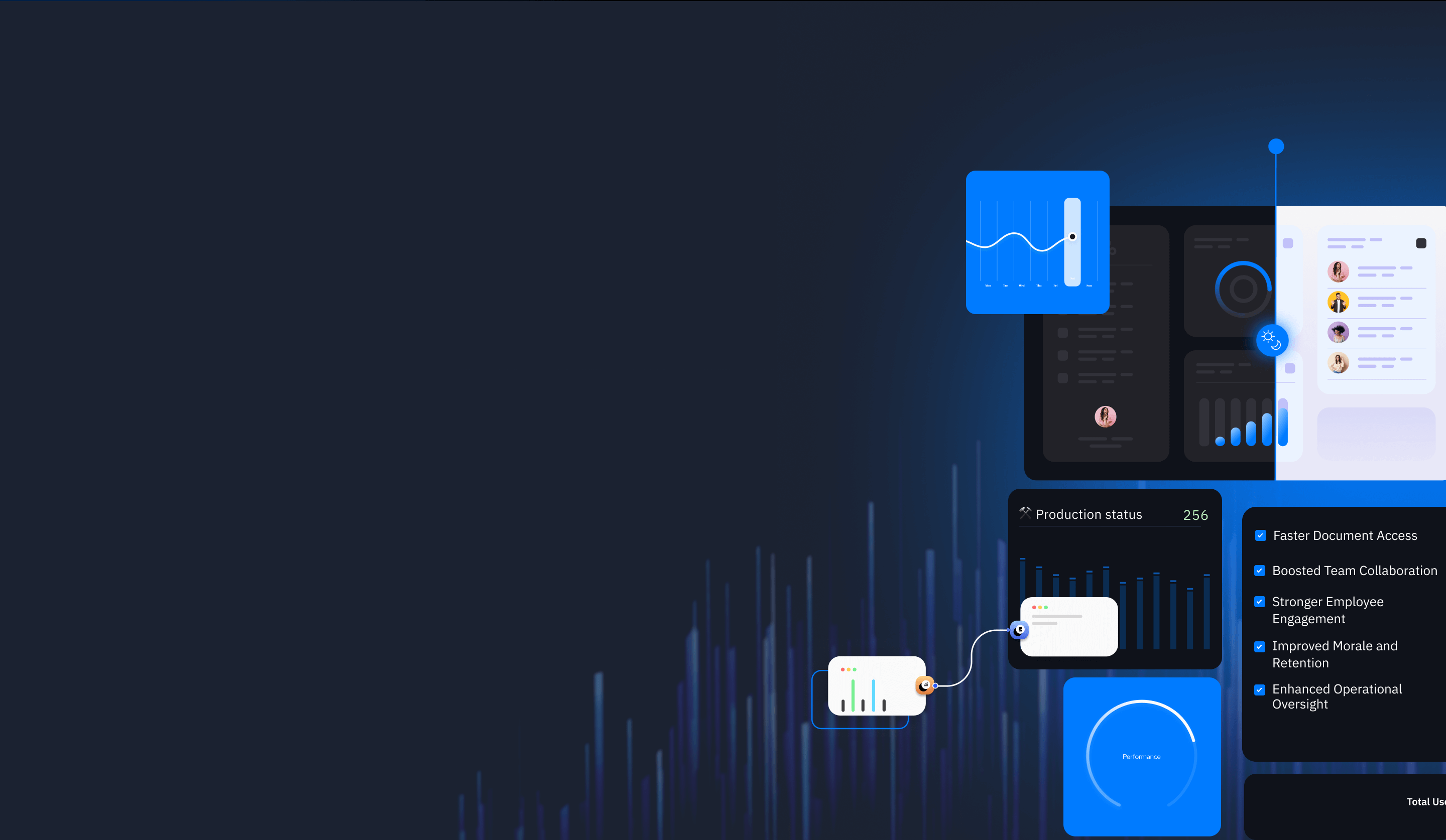

Repair shops use a modern, intuitive dashboard to create claims, nominate suppliers, validate part summaries, and track statuses in real time.

From supplier matching to real-time document validation, the integrated parts procurement software automates procurement workflows for seamless claims-to-parts alignment.

Azure Blob Storage ensures secure, scalable document handling, while Power BI integration provides embedded, drill-down analytics on claims performance.

Auto-generated IDs, conditional approvals, cancellation workflows, edit functions, and audit trails allow full control and traceability over each submitted claim.

Suppliers can be added or archived, while document exceptions and duplicates are managed through validation, editing, and revalidation mechanisms.

Panel beaters can manually upload or capture documents, validate them for exceptions, and track the full revision history for compliance assurance.

Summaries are posted for review, with the ability to approve, decline, or raise discrepancies—each linked to specific supplier transactions.

Granular roles allow claim handlers to process workflows based on value thresholds, ensuring security, compliance, and operational separation.

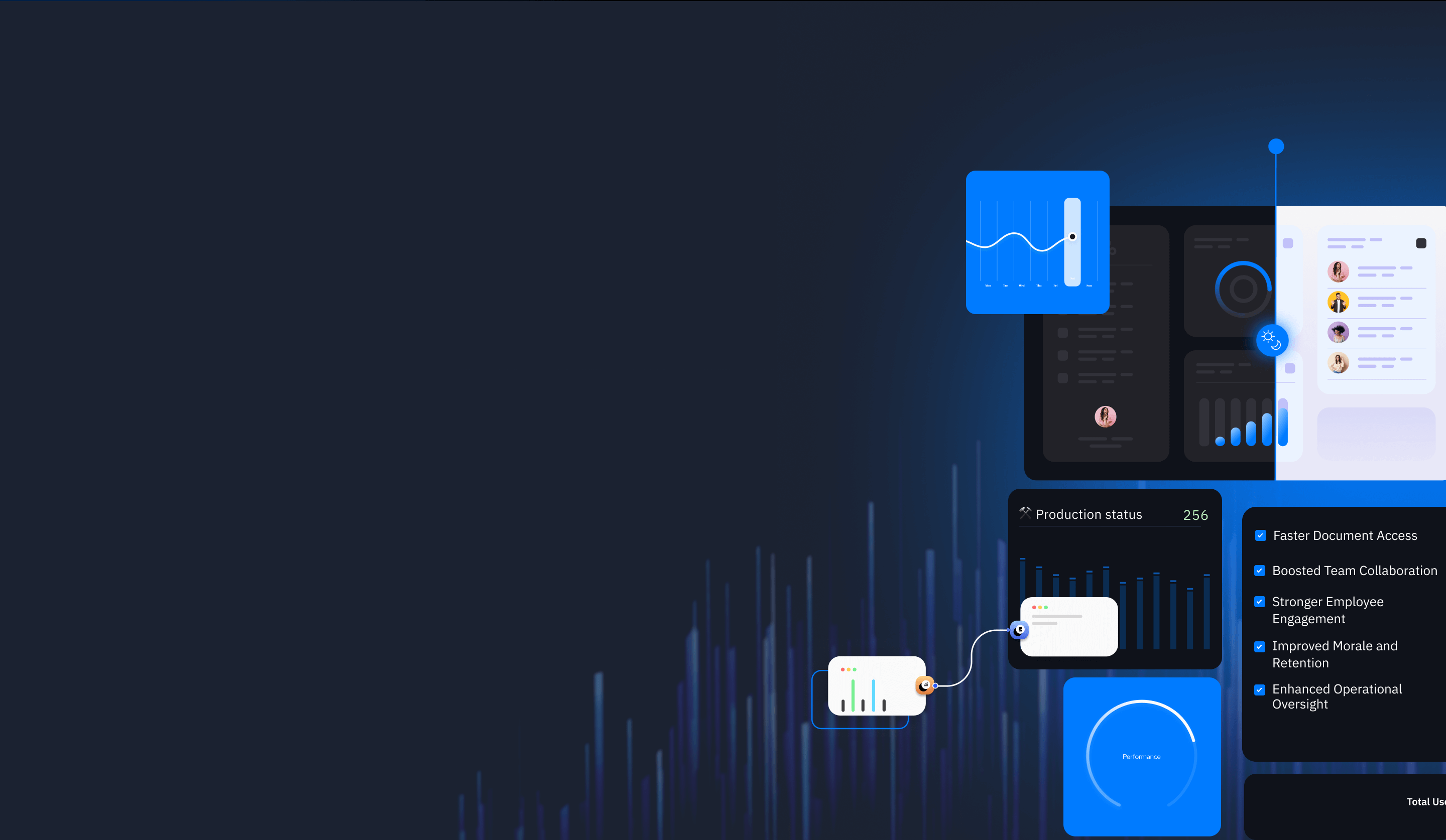

Embedded motor insurance claims software analytics offer performance overviews, supplier trends, and claim breakdowns through interactive dashboards and logs.

Ant Design

Redux Toolkit

React 18

ESLint

.png)

Husky (for code quality and consistency)

Entity Framework Core

.Net

Microsoft SQL Server

Power BI

AutoMapper

Azure

Credit validation and approval workflows are now automated, drastically reducing the time required to approve and process repair claims.

Integrating suppliers directly into the claims platform improved transparency, procurement speed, and part availability, eliminating repetitive back-and-forth.

All stakeholders now manage and monitor workflows from a single interface, reducing email trails and improving response times.

With fewer manual interventions, suppliers experience smoother settlements and reduced overhead from invoice disputes and document revalidation.

Repairers benefit from access to a nationwide supplier network, competitive rebates, and reduced dependency on credit constraints.

The platform’s architecture ensures adaptability for evolving needs—providing a solid foundation for long-term growth in claims management software development.

Secure, scalable healthcare practice management software for allied health clinics, streamlining scheduling, billing, and patient care.

Discover trusted medical treatment abroad with our medical tourism platform, offering secure bookings, consultations, and global care coordination.

Streamlined behavioral health billing with cloud-based RCM software, AI-driven claims management, and real-time insurance integration.

Cloud-based EMR and behavioral health EHR with patient engagement software, HIPAA compliant portal, and secure healthcare analytics for better care delivery.

HIPAA-compliant SaaS healthcare platform unifying IoT in healthcare, RPM, and automated reporting for chronic disease and public-health programs.

HIPAA-compliant telehealth physical therapy platform with remote patient monitoring, guided rehab, and analytics to improve MSK recovery outcomes.

Scalable wellness app development with appointment scheduling API, secure user authentication, and health metrics dashboard for measurable outcomes.

Explore remote patient monitoring software for chronic care, behavioral health, and transitional care compliant, scalable, and patient-focused.

HIPAA-compliant AI telehealth app with computer vision for MSK care, real-time motion tracking, pain mapping, and remote patient monitoring.

AI-powered mental wellness app with 24/7 emotional support, mood tracking, habit coaching, and secure analytics for scalable mental health care.

Streamline care delivery with healthcare management software integrating medical billing, workforce tracking, and revenue cycle automation.

HIPAA-compliant behavioral health EHR software streamlining clinical, billing, and intake workflows for mental health, recovery, and human services providers.

A scalable cloud-based claims administration platform for TPAs, insurers, and Medicare providers—streamlining onboarding, processing, and analytics.

Custom cloud-based fitness app with virtual coaching, workout tracking, nutrition plans, and goal-driven features for trainers, users, and admins.

We built a secure, scalable telehealth app with remote patient monitoring for Australian healthcare—delivering virtual consultations, billing, and compliance.

Eco-friendly affiliate marketing software enabling carbon-neutral shopping, coupon savings, and real-time carbon emission tracking at scale.

Discover a cloud-based POS and retail ERP system unifying HR, inventory, ticketing, and training—built for multi-store retail business efficiency.

Scalable SaaS gift registry platform for nonprofits, delivering charity gifting software solutions with secure payments and rural development impact.

Boost florist sales with our SaaS eCommerce platform for B2B & B2C. POS, CRM, and mobile tools streamline operations and enhance customer retention.

Cloud-based tanning salon software with POS, booking, automation, and analytics to streamline operations and boost customer retention.

.png)

Cyclist-first marketplace with events, bike-friendly lodging, and gear shops—built with Laravel for scalable vacation rental app development services.

Cloud-based CRE marketing software with online real estate BOV module, MLS integration, and marketing automation for faster property deals.

Streamline rentals with tenant management software, AI in property management, and proptech software development for smarter real estate operations.

Discover our scalable virtual learning platform development with real-time classes, session management dashboard, and learning management system services.

Custom online lesson planner and eLearning platform for K–12 & higher ed—curated content, student tagging, and reusable templates for impactful teaching.

Modular academic advising software and degree planning tool with ERP integration, secure role-based access, and real-time course scheduling.

AI-powered online education platform with interactive eTextbooks, adaptive assessments, and real-time analytics to boost engagement and readiness.

All-in-one employee engagement platform uniting communication, learning, and recognition to boost productivity and collaboration in modern workplaces.

Automated B2B invoicing software with recurring billing, real-time tracking, and Azure serverless architecture for secure, scalable operations.

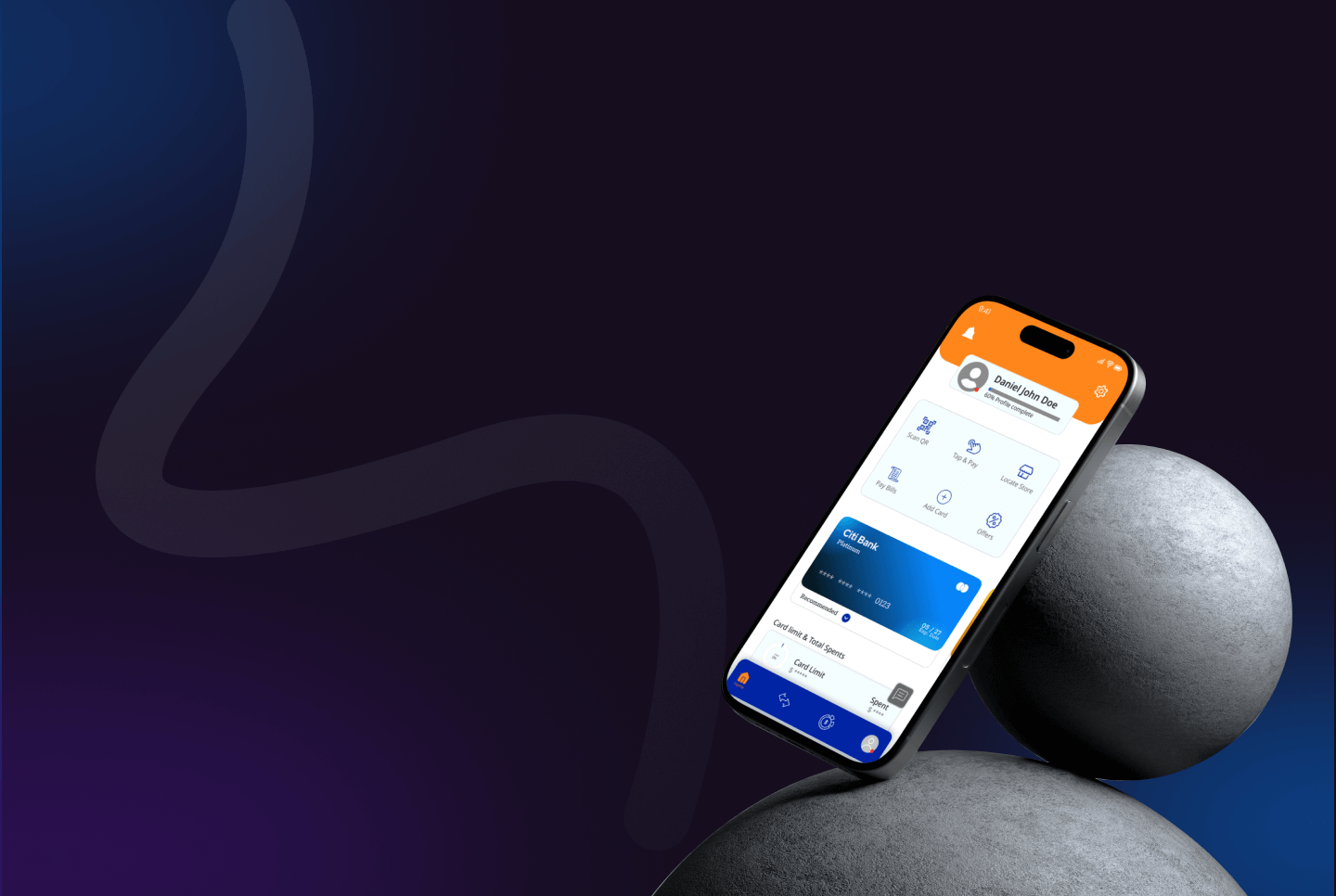

End-to-end digital lending platform with BNPL, auto lease software, and Arabic localization, built by a leading fintech software development company.

Scalable fintech app for currency exchange, forex cards, and remittances—delivering automation, compliance, and real-time global transactions.

Custom fintech app unifying 100+ services into a B2B/B2C fintech solution with real-time visibility and automated workflows.

Enterprise platform for automated trade data ingestion. Multi vendor marketplace development and service marketplace app development with Snowflake & Salesforce.

Secure cross border payment platform with digital wallet app, invoicing, subscriptions, and ML-based fraud detection for global businesses.

Discover a SaaS fintech platform on Azure that streamlines loan management, lender integration, and financing workflows, delivering instant approvals and enhanced customer experience.

Auto claims management software with parts procurement, BI analytics, and workflow automation to streamline insurance repairs and supplier collaboration.

Responsible sourcing software with ESG compliance tools, human rights due diligence, and supply chain transparency to improve worker engagement.

Automotive lending software automating dealer loan workflows with real-time integrations, fee validation, and instant approvals for faster financing.

Automated rental management system with online rental booking software to boost efficiency, bookings, and customer experience for rental businesses.

End-to-end truck repair management software with automation, digital vehicle inspections, and multi-branch scalability for auto repair businesses.

Discover how our SMS automation software and referral marketing platform helped small businesses boost acquisition, loyalty, and ROI.

Digital customs document clearance software for freight forwarders with real-time tracking, automation, and compliance-ready solutions.

Custom AI face recognition software with biometric security, legal takedowns, and verified access to safeguard digital privacy and identity.

Built a real-time payment analytics platform for the Govt aided platforms with workflow automation solutions and multilingual workflow automation capabilities.

Cloud-based CRE marketing software with online real estate BOV module, MLS integration, and marketing automation for faster property deals.

Enterprise SaaS for automated billing with RBAC implementation and single sign-on integration, boosting accuracy, governance, and global finance workflows.

AI-driven legal document automation software with clause libraries, logic management, and CLM integration—boosting accuracy, compliance, and speed.

Streamline rentals with tenant management software, AI in property management, and proptech software development for smarter real estate operations.

Streamlined behavioral health billing with cloud-based RCM software, AI-driven claims management, and real-time insurance integration.

Cloud-based EMR and behavioral health EHR with patient engagement software, HIPAA compliant portal, and secure healthcare analytics for better care delivery.

Auto claims management software with parts procurement, BI analytics, and workflow automation to streamline insurance repairs and supplier collaboration.

Cloud-based tanning salon software with POS, booking, automation, and analytics to streamline operations and boost customer retention.

Azure-hosted court case management software enabling secure workflows, real-time data sync, and streamlined inter-agency coordination.

Real-time whale sightings app and whale alert system using advanced marine conservation technology for ocean wildlife protection and tracking.

Automated B2B invoicing software with recurring billing, real-time tracking, and Azure serverless architecture for secure, scalable operations.

Scalable wellness app development with appointment scheduling API, secure user authentication, and health metrics dashboard for measurable outcomes.

Enterprise SaaS IoT asset tracking software for security operations with real-time monitoring, incident reporting, and mobile-ready dashboards.

Modernize urban mobility with our smart parking management system. Explore intelligent parking solutions for cities to streamline tracking, payments & enforcement.

All-in-one employee engagement platform uniting communication, learning, and recognition to boost productivity and collaboration in modern workplaces.

A creative scorebook collaboration platform with real-time notation, event integration, and multi-device access—built for musicians, educators, and ensembles.

We developed a construction safety management platform with real-time risk tracking, gamification, and offline access for high-risk industries.

AI-powered marijuana detection device with VR-based eye tracking, automated sobriety test workflows, and secure video processing for compliance.

AI-powered smart farm monitoring system with ammonia sensor barn tracking, real-time alerts, and predictive insights for safer, compliant operations.

A centralized SaaS platform for motorcycle and powersports dealers—streamlining sales, financing, insurance, and trade-ins for faster deal closures.

Scalable custom SaaS platform with AI advisor matching, enterprise CRM tools, and high-speed search for global expert consultations.

Streamline care delivery with healthcare management software integrating medical billing, workforce tracking, and revenue cycle automation.

Scalable B2B travel portal development integrating flights, hotels & tours with real-time booking. Built for global travel software companies.

Secure business workflow automation software integrating offender case management, financial account handling, and digital process automation services.

Discover RoadSight, a custom-built travel assistance software and an AI-powered, voice-first travel and tourism app for safer, smarter, hands-free exploration.

SaaS-based event ticketing software development with secure seat selection, Stripe payments, and real-time check-ins for modern online event management.

Eco-friendly affiliate marketing software enabling carbon-neutral shopping, coupon savings, and real-time carbon emission tracking at scale.

A secure, mobile-first offender management platform designed for pre-release and community corrections, enabling real-time tracking, secure communication, and treatment plan access to improve compliance, transparency, and rehabilitation outcomes across correctional facilities.

Enterprise platform for automated trade data ingestion. Multi vendor marketplace development and service marketplace app development with Snowflake & Salesforce.

Cloud-based SaaS asset management software with real-time alerts, predictive analytics, and reporting to replace manual tracking and boost efficiency.

A secure, mobile-first offender case management platform with GPS tracking, secure messaging, and automation to boost compliance and transparency.

Discover a SaaS fintech platform on Azure that streamlines loan management, lender integration, and financing workflows, delivering instant approvals and enhanced customer experience.

Discover a cloud-based POS and retail ERP system unifying HR, inventory, ticketing, and training—built for multi-store retail business efficiency.

ASAM-based addiction management software for treatment centers. Streamline substance abuse treatment with structured care plans and integrated billing.

Cloud-based tour booking platform with AI-driven tools for fishing charters, hiking tours, and guides. Secure payments, scalability, and growth-ready SaaS.

.png)

Cyclist-first marketplace with events, bike-friendly lodging, and gear shops—built with Laravel for scalable vacation rental app development services.

A secure, scalable Peer to Peer Rental Marketplace enabling local item sharing, reducing waste, and empowering communities to monetize idle assets with safe, intuitive rental workflows and smart transaction controls.

Scalable UGC marketplace app with escrow, FedEx, licensing & analytics—built by an expert marketplace app development company for secure brand-creator campaigns.

Discover crowdfunding app development with donation matching, SaaS dashboards, and recurring memberships for nonprofits and crowdfunded.

A smart parking solutions with real-time search, booking, and payments. Scalable parking management system for drivers, hosts, and admins.

Automated rental management system with online rental booking software to boost efficiency, bookings, and customer experience for rental businesses.

Discover our scalable virtual learning platform development with real-time classes, session management dashboard, and learning management system services.

Enterprise platform for automated trade data ingestion. Multi vendor marketplace development and service marketplace app development with Snowflake & Salesforce.

Custom cloud-based fitness app with virtual coaching, workout tracking, nutrition plans, and goal-driven features for trainers, users, and admins.

Cloud-based tour booking platform with AI-driven tools for fishing charters, hiking tours, and guides. Secure payments, scalability, and growth-ready SaaS.

HIPAA-compliant on-demand marketplace for therapy with real-time scheduling, secure profiles, and scalable open-source software for therapists.

Discover trusted medical treatment abroad with our medical tourism platform, offering secure bookings, consultations, and global care coordination.

Digital customs document clearance software for freight forwarders with real-time tracking, automation, and compliance-ready solutions.

Cloud-native IoT tracking system with GPS, video intelligence, and remote device control for scalable, future-ready asset management across industries.

IoT-based energy monitoring system using smart power quality analytics for real-time tracking, cost savings, and sustainability in facilities.

Smart IoT lighting and HVAC control system with QR code access control and real-time energy management for efficient building operations.

Enterprise SaaS IoT asset tracking software for security operations with real-time monitoring, incident reporting, and mobile-ready dashboards.

Modernize urban mobility with our smart parking management system. Explore intelligent parking solutions for cities to streamline tracking, payments & enforcement.

IoT-driven smart greenhouse automation with climate control, soil moisture sensors, and Hortimod OS for precision agriculture and higher yields.

AI-powered smart farm monitoring system with ammonia sensor barn tracking, real-time alerts, and predictive insights for safer, compliant operations.

Cloud-native IoT tracking system with GPS, video intelligence, and remote device control for scalable, future-ready asset management across industries.

Discover IoT-based smart water management system development services for real-time monitoring, supply control, and scalable smart city solutions.

Explore remote patient monitoring software for chronic care, behavioral health, and transitional care compliant, scalable, and patient-focused.

HIPAA-compliant SaaS healthcare platform unifying IoT in healthcare, RPM, and automated reporting for chronic disease and public-health programs.

Automotive lending software automating dealer loan workflows with real-time integrations, fee validation, and instant approvals for faster financing.

A centralized SaaS platform for motorcycle and powersports dealers—streamlining sales, financing, insurance, and trade-ins for faster deal closures.

We developed a construction safety management platform with real-time risk tracking, gamification, and offline access for high-risk industries.

IoT-based energy monitoring system using smart power quality analytics for real-time tracking, cost savings, and sustainability in facilities.

Smart IoT lighting and HVAC control system with QR code access control and real-time energy management for efficient building operations.

Discover IoT-based smart water management system development services for real-time monitoring, supply control, and scalable smart city solutions.

End-to-end truck repair management software with automation, digital vehicle inspections, and multi-branch scalability for auto repair businesses.

Built a real-time payment analytics platform for the Govt aided platforms with workflow automation solutions and multilingual workflow automation capabilities.

Cloud-based tanning salon software with POS, booking, automation, and analytics to streamline operations and boost customer retention.

ASAM-based addiction management software for treatment centers. Streamline substance abuse treatment with structured care plans and integrated billing.

Azure-hosted court case management software enabling secure workflows, real-time data sync, and streamlined inter-agency coordination.

A secure, mobile-first offender case management platform with GPS tracking, secure messaging, and automation to boost compliance and transparency.

Automotive lending software automating dealer loan workflows with real-time integrations, fee validation, and instant approvals for faster financing.

AI-driven legal document automation software with clause libraries, logic management, and CLM integration—boosting accuracy, compliance, and speed.

We developed a construction safety management platform with real-time risk tracking, gamification, and offline access for high-risk industries.

Discover a cloud-based POS and retail ERP system unifying HR, inventory, ticketing, and training—built for multi-store retail business efficiency.

A centralized SaaS platform for motorcycle and powersports dealers—streamlining sales, financing, insurance, and trade-ins for faster deal closures.

HIPAA-compliant behavioral health EHR software streamlining clinical, billing, and intake workflows for mental health, recovery, and human services providers.

A scalable cloud-based claims administration platform for TPAs, insurers, and Medicare providers—streamlining onboarding, processing, and analytics.

Scalable fintech app for currency exchange, forex cards, and remittances—delivering automation, compliance, and real-time global transactions.

AI-powered online education platform with interactive eTextbooks, adaptive assessments, and real-time analytics to boost engagement and readiness.

SaaS-based event ticketing software development with secure seat selection, Stripe payments, and real-time check-ins for modern online event management.

Discover how our SMS automation software and referral marketing platform helped small businesses boost acquisition, loyalty, and ROI.

Explore remote patient monitoring software for chronic care, behavioral health, and transitional care compliant, scalable, and patient-focused.

Automated rental management system with online rental booking software to boost efficiency, bookings, and customer experience for rental businesses.

Boost florist sales with our SaaS eCommerce platform for B2B & B2C. POS, CRM, and mobile tools streamline operations and enhance customer retention.

Custom fintech app unifying 100+ services into a B2B/B2C fintech solution with real-time visibility and automated workflows.

Enterprise SaaS for automated billing with RBAC implementation and single sign-on integration, boosting accuracy, governance, and global finance workflows.

Streamline rentals with tenant management software, AI in property management, and proptech software development for smarter real estate operations.

Scalable wellness app development with appointment scheduling API, secure user authentication, and health metrics dashboard for measurable outcomes.

Custom cloud-based fitness app with virtual coaching, workout tracking, nutrition plans, and goal-driven features for trainers, users, and admins.

Scalable UGC marketplace app with escrow, FedEx, licensing & analytics—built by an expert marketplace app development company for secure brand-creator campaigns.

HIPAA-compliant AI telehealth app with computer vision for MSK care, real-time motion tracking, pain mapping, and remote patient monitoring.

IoT-driven smart greenhouse automation with climate control, soil moisture sensors, and Hortimod OS for precision agriculture and higher yields.

Custom AI face recognition software with biometric security, legal takedowns, and verified access to safeguard digital privacy and identity.

HIPAA-compliant on-demand marketplace for therapy with real-time scheduling, secure profiles, and scalable open-source software for therapists.

A smart parking solutions with real-time search, booking, and payments. Scalable parking management system for drivers, hosts, and admins.

Discover trusted medical treatment abroad with our medical tourism platform, offering secure bookings, consultations, and global care coordination.

AI-powered marijuana detection device with VR-based eye tracking, automated sobriety test workflows, and secure video processing for compliance.

A creative scorebook collaboration platform with real-time notation, event integration, and multi-device access—built for musicians, educators, and ensembles.

AI-powered mental wellness app with 24/7 emotional support, mood tracking, habit coaching, and secure analytics for scalable mental health care.

AI-powered smart farm monitoring system with ammonia sensor barn tracking, real-time alerts, and predictive insights for safer, compliant operations.

Secure business workflow automation software integrating offender case management, financial account handling, and digital process automation services.

Cloud-based CRE marketing software with online real estate BOV module, MLS integration, and marketing automation for faster property deals.

ASAM-based addiction management software for treatment centers. Streamline substance abuse treatment with structured care plans and integrated billing.

Azure-hosted court case management software enabling secure workflows, real-time data sync, and streamlined inter-agency coordination.

AI-powered smart farm monitoring system with ammonia sensor barn tracking, real-time alerts, and predictive insights for safer, compliant operations.

Discover a SaaS fintech platform on Azure that streamlines loan management, lender integration, and financing workflows, delivering instant approvals and enhanced customer experience.

Discover a cloud-based POS and retail ERP system unifying HR, inventory, ticketing, and training—built for multi-store retail business efficiency.

Cloud-native IoT tracking system with GPS, video intelligence, and remote device control for scalable, future-ready asset management across industries.

Enterprise SaaS IoT asset tracking software for security operations with real-time monitoring, incident reporting, and mobile-ready dashboards.

A scalable cloud-based claims administration platform for TPAs, insurers, and Medicare providers—streamlining onboarding, processing, and analytics.

Transform insurance-driven repair operations with scalable workflows, automated parts procurement, and real-time analytics—all in one powerful platform.

Get a Free Demo