How Enterprise Risk Management Software for Insurance Companies Cut Risks

Table Of Content

Published Date :

18 Feb 2026

Insurance leaders operate in an environment where risk decisions directly influence growth, stability, and trust. Regulatory expectations continue to evolve, business models are becoming more complex, and even a small oversight can lead to financial exposure or reputational impact. For business owners and senior executives, the challenge is not identifying risk, but managing it consistently across the organization.

This is where enterprise risk management software for insurance companies becomes a strategic necessity. It replaces fragmented processes with a unified approach that brings clarity, accountability, and timely insight into enterprise-wide risks.

Instead of reacting to issues after they surface, leadership gains the ability to anticipate challenges and act early. For executives focused on long-term resilience and controlled growth, effective risk management is becoming a core business discipline.

Understanding Risk Challenges Faced by Insurance Companies

Insurance organizations struggle with how risks are tracked, shared, and acted upon. In many firms, underwriting teams, claims units, finance, and compliance operate with their own risk views. Data lives in different systems. Reviews happen quarterly, sometimes later. By the time leadership sees a red flag, the damage is already forming.

Here is what typically creates friction on the ground:

- Risk data spread across departments with no single source of truth

- Manual assessments that depend heavily on individual judgment

- Limited visibility into how one risk triggers another

- Reporting cycles that lag behind real-world events

One insurer we worked with discovered a solvency exposure weeks after it crossed tolerance levels. Not because tools were missing, but because insights arrived too late. And in insurance, timing changes everything.

Is Your Risk Framework Truly Future-Ready?

Gain unified visibility, reduce exposure early, and strengthen regulatory confidence with a scalable enterprise risk management platform.

What Enterprise Risk Management Software for Insurance Companies

At its core, enterprise risk management software for insurance companies brings structure to uncertainty. It creates a shared system where risks are identified, assessed, monitored, and owned across the organization. Instead of scattered documents and delayed updates, leadership gets a living view of exposure, controls, and impact.

Think of it as a control room rather than a static report. Risk events, compliance gaps, and operational issues are logged as they happen. Scores adjust based on predefined rules. Alerts move up the chain before problems grow teeth. And most importantly, risk discussions shift from opinions to evidence.

This kind of insurance risk management software does more than organize data. It connects risk appetite with daily operations. Capital planning, regulatory reporting, and strategic decisions begin to speak the same language. That alignment is what turns risk management from a defensive function into a business enabler.

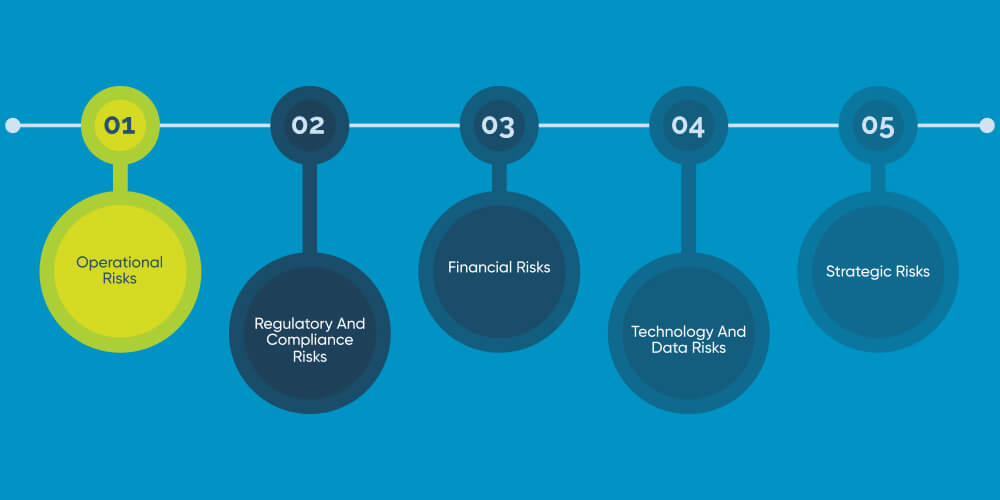

Types Of Risks ERM Platforms Help Reduce

Insurance leaders deal with many risks at once, but not all risks behave the same way. Some grow slowly. Others explode without warning. This is where risk management software for insurance companies starts proving its value, by bringing different risk categories into one structured view and showing how they connect.

Key risk areas these platforms help control include:

- Operational risks such as process gaps, system failures, or dependency on manual workarounds that quietly weaken controls

- Regulatory and compliance risks tied to solvency norms, audits, reporting timelines, and changing guidelines

- Financial risks involving reserve adequacy, capital exposure, and loss volatility across product lines

- Technology and data risks where system outages or access issues disrupt claims or underwriting

- Strategic risks linked to expansion, new products, or market shifts that carry long-term impact

A mature risk management insurance software setup does not treat these risks in isolation. It shows how a delay in claims processing can affect customer trust, capital position, and regulatory standing all at once.

How Enterprise Risk Management Software for Insurance Companies Cut Risks

This is where structure meets action. enterprise risk management software for insurance companies cuts risks by shortening the distance between detection and response. Instead of waiting for periodic reviews, risk signals surface as part of daily operations. That alone changes outcome.

Here is how the shift plays out inside insurance organizations:

- Centralized risk registers ensure every identified risk has an owner, a score, and a mitigation plan

- Automated scoring adjusts exposure levels when inputs change, removing guesswork from prioritization

- Real-time dashboards give leadership instant visibility into high-impact areas

- Scenario analysis helps teams test stress situations before they occur, not after losses appear

- Continuous monitoring replaces static reports with living insights

One insurer reduced operational loss incidents by nearly 30 percent within six months simply by acting earlier. No new policies. No extra manpower. Just better visibility powered by insurance risk management software. When risk information flows freely, decisions stop being reactive.

Want Better Visibility Across Insurance Risks?

Enable proactive risk oversight with centralized dashboards, scenario analysis, and integrated compliance tracking.

Key Features That Enable Risk Reduction

Risk reduction does not happen because software exists. It happens because the right capabilities are built into the system and actually used. Well-designed platforms focus less on flashy dashboards and more on practical control.

- Risk registers and control libraries that standardize how risks are documented and assessed

- Compliance tracking modules that align internal controls with regulatory requirements

- Incident and loss event management to capture issues the moment they occur

- Workflow-driven approvals that define accountability across teams

- Executive reporting that highlights trends instead of flooding leadership with raw data

This is where insurance software development expertise becomes critical. Insurance processes are nuanced, and generic tools rarely fit cleanly. At DITS, we integrate AI into software development, quality assurance, code maintenance, and customization so risk platforms adapt to real insurance workflows without becoming rigid or complex.

Business Impact of Risk Reduction for Insurers

When risks are managed well, the impact shows up far beyond compliance reports. Executives start noticing calmer audits, fewer last-minute escalations, and decisions that feel less rushed. That shift matters.

Here is what insurers typically experience once risk controls mature:

- Stronger regulatory confidence due to consistent, audit-ready documentation

- Faster executive decisions backed by current, reliable risk data

- Lower financial leakage from operational losses and delayed responses

- Improved coordination between underwriting, claims, finance, and compliance teams

One regional insurer cut internal audit preparation time from six weeks to under ten days after aligning risk data into a single platform. That time went back into strategic planning instead of damage control. This is where Enterprise Software Development plays a central role, enabling scalable systems that grow with regulatory and business complexity.

Implementation Considerations for Insurance Companies

Risk platforms succeed or fail long before go-live. The decisions made during planning shape how well the system supports the business later. Insurance leaders often underestimate this phase, then wonder why adoption slows.

Practical considerations that deserve attention include:

- Clear alignment between risk appetite, regulatory obligations, and business goals

- Integration with existing policy, claims, and finance systems to avoid duplicate data entry

- Phased rollout plans that prioritize high-impact risk areas first

- Change management that prepares teams for new workflows, not just new screens

Here is the catch. Many insurers try to digitize existing manual processes as-is. That rarely works. True value comes when risk workflows are redesigned as part of broader Digital Transformation Services, ensuring technology supports smarter decisions rather than preserving old inefficiencies.

Looking To Reduce Enterprise Risk Exposure?

Align compliance, underwriting, and capital planning through a structured ERM platform designed for insurance complexity.

Choosing Right ERM Software Partner

Selecting a risk platform is only half the decision. The bigger question is who builds and adapts it over time. Insurance risk environments evolve quickly, and static tools fall behind just as fast. A reliable partner understands insurance operations, regulatory realities, and enterprise-scale delivery.

What decision-makers should look for:

- Proven experience with insurance-specific risk workflows

- Ability to tailor solutions instead of forcing rigid templates

- Strong focus on security, data governance, and audit readiness

- Long-term support for upgrades, regulatory changes, and expansion

This is where Custom Application Development becomes valuable. At DITS, platforms are designed around real operating conditions, not assumptions. AI is embedded thoughtfully into development, quality assurance, and ongoing optimization, helping teams maintain accuracy, performance, and flexibility without adding complexity.

Why Choose DITS For Enterprise Risk Management Software For Insurance

Choosing the right platform is important, but choosing the right technology partner determines whether that platform actually delivers value. Insurance risk environments are complex, tightly regulated, and constantly evolving. DITS builds with that reality in mind.

Here is what sets DITS apart when delivering enterprise software development for insurance companies:

- Deep understanding of insurance operations, from underwriting and claims to compliance and capital planning

- Enterprise-grade architecture designed for scale, security, and long-term regulatory alignment

- Flexible risk frameworks that adapt as business models, products, and regulations change

- Strong governance workflows that support accountability across departments, not just IT

At DITS, AI is embedded across software development, quality assurance, code quality monitoring, and customization. This helps reduce errors, speed up testing cycles, and tailor risk workflows to real-world insurance scenarios without bloating the system. The result is a platform that stays reliable under pressure and evolves without disruption.

Conclusion

Risk will always be part of insurance. What changes is how well it is controlled. With enterprise risk management software for insurance companies, insurers move from reactive firefighting to structured foresight. Risks are identified earlier, decisions are grounded in data, and leadership gains clarity instead of surprises.

More importantly, risk management stops being viewed as a cost center. It becomes a stabilizer for growth, protecting capital, reputation, and customer trust at the same time. For insurance leaders focused on long-term resilience, adopting the right risk management software for insurance companies is no longer optional. It is a strategic move that shapes how confidently the business moves forward.

FAQs

What problems does enterprise risk management software solve for insurance companies?

It helps insurers identify, track, and control risks across departments in a structured way. Instead of relying on spreadsheets or delayed reviews, leadership gets timely visibility into operational, regulatory, and financial exposures, making decision-making faster and more reliable.

How DITS offer risk management software for insurance different fom generic ERM tools?

DITS builds risk management software for insurance around real insurance workflows, not generic enterprise assumptions. It aligns risk registers, controls, and reporting with underwriting, claims, compliance, and capital planning needs, ensuring the platform fits how insurers actually operate.

How long does it take to implement an ERM platform in an insurance organization?

Implementation timelines vary based on scope and integrations, but most insurers see a phased rollout within three to six months. High-risk areas are usually prioritized first, delivering value early while the platform expands across the organization.

Can ERM software support regulatory audits and compliance reviews?

Yes. A well-implemented system maintains audit trails, control documentation, and compliance evidence in one place. This reduces preparation time, minimizes last-minute escalations, and improves regulator confidence during reviews.

Is risk management software for insurance offered by DITS, scalable?

DITS builds risk management software for insurance to scale with changing regulations, new products, and expanding operations. The architecture supports growth without forcing insurers to replace systems every few years, protecting long-term technology investments.

Dinesh Thakur

21+ years of IT software development experience in different domains like Business Automation, Healthcare, Retail, Workflow automation, Transportation and logistics, Compliance, Risk Mitigation, POS, etc. Hands-on experience in dealing with overseas clients and providing them with an apt solution to their business needs.

Recent Posts

A practical breakdown of AI Agent Development Cost, covering scope, data, integration, infrastructure, and ongoing expenses to support informed enterprise investment decisions.

Why develop in-house when you can outsource? From access to global talent to cost-cutting and quick time to market, discover all the benefits of outsourcing software development.

AI chatbots help Middle East enterprises automate workflows, connect legacy systems, improve compliance, and boost operational efficiency without disruptive infrastructure overhauls across growing regional markets.