How Maritime Insurance Claim Software Helps Marine Businesses Manage Complex Claims

Table Of Content

Published Date :

02 Feb 2026

Maritime insurance claims have become a boardroom issue, not just an operational one. A single incident can quickly escalate into a high-value exposure that involves multiple jurisdictions, regulatory scrutiny, legal review, and reputational risk. For marine business owners and senior executives, the real challenge is the lack of process visibility and control rights that begin at process initiation.

Traditional claim processing methods face difficulties because they operate in a different environment. The existing system generates delays that fragment data and produce inconsistent results, preventing leadership teams from executing their risk assessment, reserve management, and decision-making tasks. Marine businesses need maritime insurance claim software because it is an essential operational tool. Executives use structured, transparent, and accountable claim management systems to handle their complex claims processes.

The blog post explains how marine businesses face challenges with their complex insurance claims processes and demonstrates how maritime insurance claim software offers a solution.

Growing Complexity of Maritime Insurance Claims

Marine businesses now operate across more ports, jurisdictions, and contractual frameworks than ever before. A single incident of hull damage can trigger parallel conversations with insurers, P&I clubs, surveyors, port authorities, and legal teams, all of whom work across different time zones.

The claims process has become more complex because it now requires multiple insurance policies to be evaluated, while multiple parties share financial responsibilities, and new reporting rules must be followed. The documentation needs to be complete and precise because any errors will cause settlement delays or legal disputes.

The presence of valuable cargo, strict voyage timelines, and active regulatory monitoring creates a situation in which mistakes become increasingly difficult to manage. The organization has established a claims process that relies entirely on manual methods and cannot meet operational demands, resulting in executive personnel having restricted access to necessary information.

Need Better Control Over Claims Exposure?

Replace fragmented claim handling with a centralized system designed for multi-party, multi-policy maritime insurance environments.

Why Manual Claim Handling No Longer Works

Manual claim handling becomes unmanageable because its operational capacity becomes insufficient during its first significant operational test. The combination of spreadsheets, email threads, and disconnected document folders provides short-term benefits but creates problems when claims become intricate and urgent.

Information tends to sit in silos, which prevents departments and external partners from accessing shared resources. The system generates late status updates, which result in lost documents and create a situation where nobody accepts responsibility. The process of handling claims through manual methods creates two problems: it extends the time needed for approval, and it raises the probability of making mistakes when multiple claims occur at the same time.

The organization requires its financial operations to function efficiently because any operational delays will result in increased financial risks for the organization.

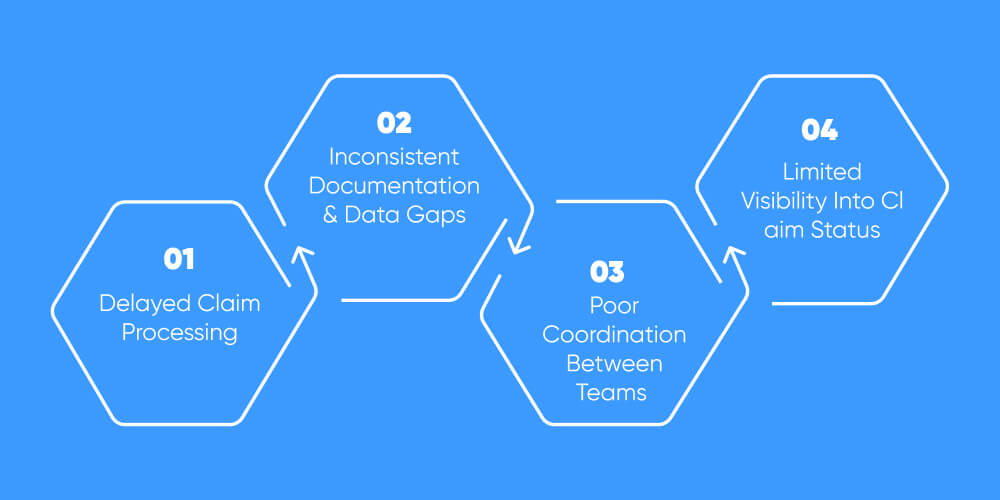

Challenges of Claim Management Faced By Marine Businesses

Marine organizations which have existed for a long time face persistent problems with their claim management processes because their systems depend on manual operations. The challenges emerge only after an incident happens when organizations need to manage their time and ensure precise outcomes while maintaining responsibility.

Delayed Claim Processing

Internal approval processes, document requirements, and external party response times cause claims to experience delays. Financial exposure increases for leadership teams because their inability to control reserve levels creates ongoing uncertainty.

Inconsistent Documentation & Data Gaps

The organization keeps incident reports, survey findings, and policy details in multiple systems, which use different storage formats. Small errors create problems for insurers who need to investigate and conduct legal reviews which results in longer settlement periods and greater chances of disputes.

Poor Coordination Between Teams

The different teams which include operations and legal and finance and insurers and surveyors need to establish cooperative work procedures instead of operating independently. Information flow between different parties gets interrupted because there is no common platform which results in multiple parties needing to check in repeatedly with one another.

Limited Visibility Into Claim Status

Another obstacle that executives face involves their inability to access current operational information. Executives need real-time access to claim status information which impacts their financial decisions because they require a complete contextual understanding at all times.

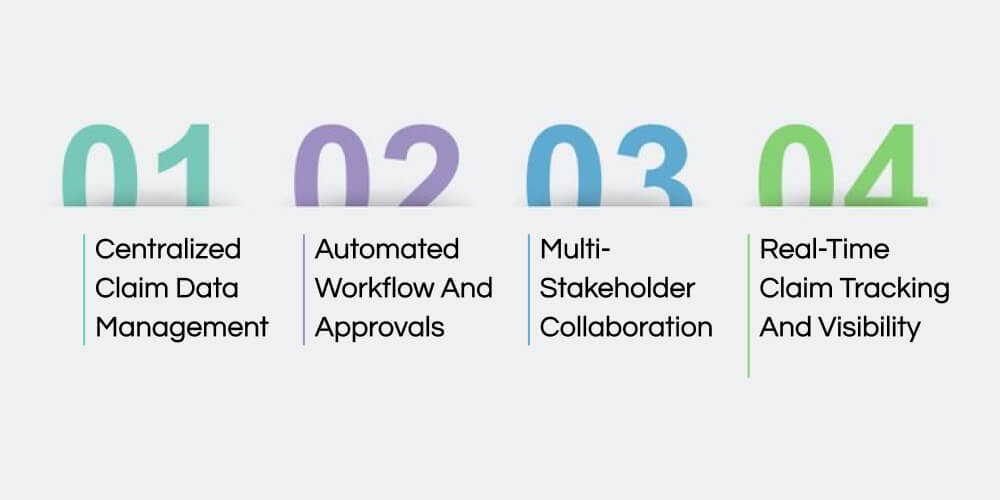

How Maritime Insurance Claim Software Simplifies Claims

The existence of multiple vessels and jurisdictions together with third party involvement makes structural systems necessary to achieve centralized control for handling operational activities. The operational value of maritime insurance claim software supports marine businesses by providing operational protection which enables them to handle risk management across their entire organization.

Centralized Claim Data Management

Instead of chasing information across emails and shared drives all claim-related data lives in one system. The system maintains real-time updates for the storage of vessel details together with incident reports, survey documents, policy references, and all correspondence. The single view presents all necessary information, which enables decision makers to work with complete and up-to-date data.

Automated Workflow And Approvals

The system tracks claims through defined stages that begin with incident reports and culminate in a final settlement, while showing who is responsible for each stage. Manual follow-ups are no longer required for the approval process. Business Workflow Automation at this level enables faster operational processes while decreasing the potential for mistakes, which normally happen during times of extreme work pressure.

Multi-Stakeholder Collaboration

Insurers surveyors legal teams and internal departments all share a secure environment which they can access at all times. The system enables faster information flow which leads to quicker question resolution and helps prevent decision-making from being delayed by information stuck in inboxes.

Real-Time Claim Tracking And Visibility

Executives obtain real-time updates about the current status of claims and their financial risks and time estimations. The system enables better reserve management while providing improved risk assessment capabilities and reducing unexpected findings.

Still Managing Claims Manually?

Modernize maritime insurance claim operations with automation, accountability, and data-driven decision support.

Managing Regulatory And Compliance Needs

Regulatory compliance in maritime insurance is not straightforward. Claims often cross borders, fall under different maritime conventions, and require strict documentation standards. For marine businesses, even a small compliance gap can delay settlements or trigger regulatory scrutiny, something leadership teams prefer to avoid.

A structured claims system helps standardize documentation from the start. Required forms, incident records, and survey reports, are captured in consistent formats, making audits less disruptive. Built-in logs create clear audit trails, showing who did what and when.

Many organizations approach this shift as part of a broader digital transformation, moving away from reactive compliance toward controlled, repeatable processes that stand up under review. DITS offers digital transformation services to marine businesses worldwide, helping them manage records, reports, and communications in digital formats to be audit-ready and comply with regulations.

Business Benefits For Marine Companies and Insurers

When claim processes are structured and visible, the impact reaches far beyond the claims department. Marine businesses begin to see measurable operational and financial improvements that matter at the executive level.

Faster Claim Resolution and Reduced Costs

Clear workflows and centralized information shorten settlement cycles. Fewer delays mean lower administrative overhead and less time spent chasing updates.

Improved Accuracy in Assessments and Settlements

Consistent data and documented decisions reduce estimation errors. This leads to fairer settlements and fewer follow-up disputes with insurers or third parties.

Stronger Risk Management and Decision Support

With real-time visibility into exposure and trends, leadership teams can assess risk earlier and make informed reserve and policy decisions.

Better Client and Partner Satisfaction

Quicker responses and transparent communication build trust with insurers, cargo owners, and partners. Over time, that reliability becomes a competitive advantage.

Use Cases of Maritime Insurance Claim Software

Certain claim scenarios expose process weaknesses more quickly than others. These are also the areas where structured claim systems create immediate business impact.

Hull and Machinery Claims

Damage assessments often involve technical inspections, repair estimates, and coordination across yards and insurers. A centralized system keeps reports, approvals, and cost tracking aligned, helping leadership teams control timelines and spend.

Cargo Damage and Loss Claims

High-value cargo incidents demand precise documentation and fast communication. Structured claim records reduce disputes and support quicker resolution, especially when multiple parties are involved.

P&I and Third-Party Liability Claims

These claims carry legal and reputational risk. Clear audit trails, controlled access, and documented decisions support defensible outcomes and smoother coordination with legal advisors.

Multi-Vessel or Fleet-Wide Incidents

When incidents affect more than one vessel, visibility becomes critical. Integrated systems, often built through Maritime & logistics software development, allow executives to track exposure across the fleet and prioritize actions without losing oversight.

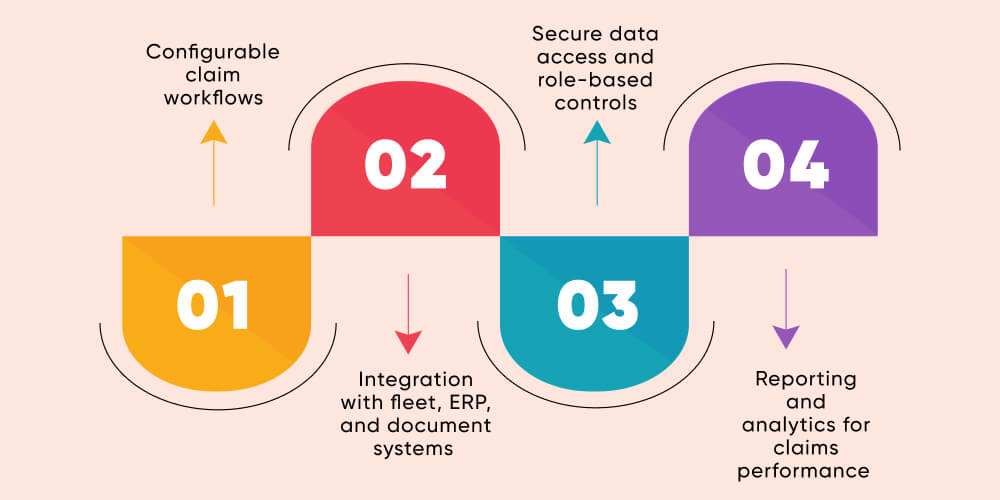

Key Features of Maritime Insurance Claim Software

Choosing the right solution is less about feature volume and more about fit. For marine businesses managing complex claims, certain capabilities make a real difference in daily operations and executive oversight.

Configurable claim workflows

Every organization handles claims differently. The system should allow workflows to be tailored around internal approval structures, insurer requirements, and policy conditions without heavy rework.

Integration with fleet, ERP, and document systems

Claims do not exist in isolation. Seamless data exchange with fleet management tools, finance systems, and document repositories prevents duplication and keeps information consistent across the business.

Secure data access and role-based controls

Sensitive claim data must be visible only to the right people. Role-based access ensures confidentiality while still enabling collaboration with insurers and surveyors.

Reporting and analytics for claims performance

Clear dashboards and reports help leadership teams track settlement timelines, exposure trends, and recurring risk areas. Many organizations rely on IT Consulting Services at this stage to align reporting with decision-making needs. DITS provides IT Consulting Services to marine businesses to help them identify problems and recommend solutions to make operations smooth and efficient.

Looking To Reduce Claim Delays?

Streamline approvals, improve coordination, and accelerate settlements with purpose-built maritime insurance claim software.

Why Choose DITS For Maritime Insurance Claim Software

Marine insurance claims demand more than generic tools. They require systems that understand maritime operations, insurance workflows, and regulatory pressure points. At DITS, we approach this space with a clear focus on building solutions that support real-world decision-making, not just process automation.

Our strength lies in custom insurance software development tailored to complex claim environments. We design platforms that align with how marine businesses actually operate, from incident reporting to settlement and post-claim analysis. Every workflow, data field, and approval path is built around practical use cases, not assumptions.

DITS also brings deep experience across marine operations and enterprise systems, supported by structured IT Consulting Services to ensure integrations, compliance needs, and reporting requirements are addressed upfront. Behind the scenes, we use AI to support software development, quality assurance, code quality checks, and customization, helping deliver stable, scalable systems that evolve with your business.

Conclusion

Maritime insurance claims have become permanent organizational functions that create financial risks and legal obligations and affect corporate choices. As claims become more complex, our organization faces heightened risk because our manual processing system prevents us from achieving optimal leadership visibility during crucial decision-making times.

The correct maritime insurance claim software system establishes organized processes that enable transparent operations and allow users to control all aspects of their claims handling process. The system enables maritime companies to enhance their response times while creating better risk management systems and sustaining trust with their insurance companies, business partners, and regulatory authorities. The system transforms claims from a reactive burden into a process that organizations can manage through data-driven insights. Organizations seeking long-term operational strength and effective processes must now implement structured claim management systems as their primary approach.

FAQs

What types of marine businesses benefit most from maritime insurance claim software?

Marine businesses managing high-value vessels, cargo operations, or fleet-wide insurance exposure benefit the most. This includes ship owners, operators, P&I clubs, and marine insurers that need tighter control over claim timelines, documentation, and financial exposure.

How does maritime insurance claim software improve executive visibility and control?

It provides real-time insight into claim status, reserves, and risk exposure through centralized dashboards and reports. This allows leadership teams to make faster, data-backed decisions instead of relying on delayed updates or fragmented information.

Can maritime insurance claim software be customized to fit existing claim processes?

Yes. Most marine organizations have unique workflows shaped by policy structures and regulatory requirements. Through custom insurance software development, DITS builds solutions that adapt to existing approval flows, reporting needs, and operational structures rather than forcing process changes.

How does the software support regulatory and audit requirements in maritime insurance?

The system maintains standardized documentation, time-stamped activity logs, and complete audit trails. This makes regulatory reviews, insurer audits, and legal checks more predictable and less disruptive.

Does DITS provide advisory support before implementing maritime insurance claim software?

Yes. DITS offers IT Consulting Services to assess current claim processes, integration needs, and compliance risks before development begins. This ensures the solution aligns with both operational realities and executive expectations from day one.

Dinesh Thakur

21+ years of IT software development experience in different domains like Business Automation, Healthcare, Retail, Workflow automation, Transportation and logistics, Compliance, Risk Mitigation, POS, etc. Hands-on experience in dealing with overseas clients and providing them with an apt solution to their business needs.

Recent Posts

Learn how insurance agency management software company platforms embed governance, automate compliance, enhance data control, and give leadership real time visibility for scalable operations growth.

From real-time tracking to proactive maintenance, IoT offers significant benefits for fleet management. Dive into IoT fleet management use cases and advantages in this blog.

A strategic overview of how mining-focused project management software improves cost control, resource planning, visibility, and executive decision-making across complex, multi-site mining operations globally today.

Doha Exhibition and Convention Center (DECC)

Doha Exhibition and Convention Center (DECC)